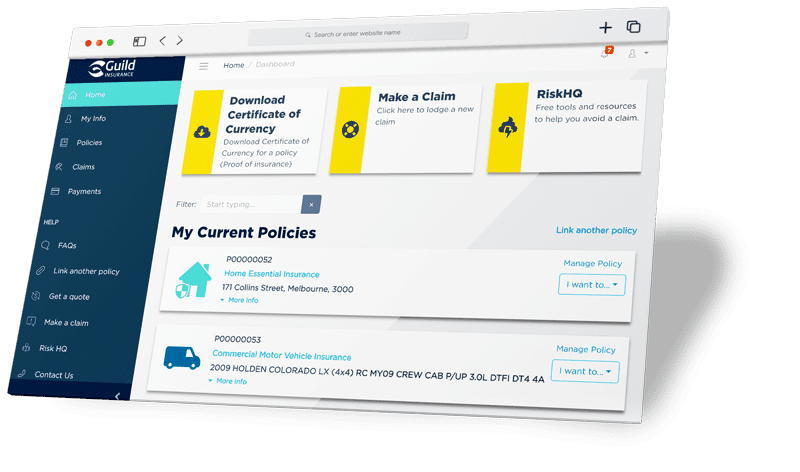

PolicyHub

We understand that managing your insurance isn’t always at the top of your to-do list. And that’s why we developed PolicyHub – our online self-service portal.

Recent updates

- We've made it easier to see all your policies in one place

- Create access using email or social media

- Improved security with multi-factor authentication

Have oversight of your policies

You can view your policy and account information for multiple policies all in one place.

Log in to PolicyHub to access your current policy information and, historical documents for your record keeping.

Policy documents and tax invoices

Access your policy documents and tax invoices simply when you log in to PolicyHub

Here are some of the documents you can get through your PolicyHub account:

- Policy Disclosure Statement (PDS)

- Policy Schedule

- Payment Invoice

- Tax invoice

- Certificate of Currency

If there are other documents that you cannot find in PolicyHub, please contact us on 1800 810 213

Update your personal details

You can make updates to your personal details such as phone number, email, postal address and more.

To update your personal details you can login to PolicyHub and select the policy you need to update in your dashboard.

Here are some of the things you can update:

- Phone number

- Email address

- Postal address and more

Certificate of Currency

We understand that getting what you need when you need it is important.

Create a new, or access previous Certificate of currency / Proof of insurance for one or multiple policies all in one dashboard.

Update your business address

Your are now able to update your business address in PolicyHub for Combined Liability Policies. Launching for a select few markets, all other remaining industries will follow in early 2024.

- Fitness/FALP

- Aqua Exercise Instructors

- Yoga Pilates Instructors

- Speech Pathologists

- Dietitians

- Acupuncturists

- Occupational Therapists

- IT Professionals

- Paramedics

- Dental Prosthetics

- Natural Therapists

- Chiropractors

- Osteopaths

- Physiotherapists

Update your payments/billing details

You can update your payment and billing details through PolicyHub.

If you want to switch to Pay by the Month, you can do so through PolicyHub as well.

To update your payment details you can login to PolicyHub and select the details in your dashboard.

Here are some of the things you can update:

- Change your payment details

- Update card details

- Change your payment method from credit card to EFT or vice versa

- View invoices

- Make payments

- Change to pay by the month

- Update multiple policy payment details at onc

View your claims

You can view both your current and past claim information for each of your policies in PolicyHub.

If you need to make a claim please visit our claims information.

Here are some of the claims information availabile in your PolicyHub account:

- Details and progress of your claim

- Parties involved in your claim and their contact details

- Download documents and payment invoices related to your claim

- Who your claims handler is and their contact details

- Request an update on past and current claims

For any further information on your claim that you cannot find in PolicyHubplease contact us on 1800 810 213

Renew your policy

You can renew your policy quickly and easily online through

If you wish to view more of your policy details first, you can log in to PolicyHub and pay also.

Policy reinstatement

If your policy has recently lapsed from a missed monthly payment or unpaid renewal it can be reinstated via PolicyHub.

Dentist ORMS or Chiropractor RMO

As a Guild-insured dentist or chiropractor, there are certain risk management offers that allow for potential discounts on your policy. These can be accessed through PolicyHub.

- ACA Risk Managed Offer for Chiropractors

- Online Risk Management Solution for Dentists

Temporary Leave of Absence (TLOA)

TLOA is available to customers who hold a policy as an individual or sole trader with no Vicarious Liability under specific circumstances:

- Paternal leave

- Illness or injury

- Study

- Travel or holiday

TLOA is for a min. of six (6) months and a max. of thirty (30) months. You will still be covered for any claims that may arise for incidents or events that occurred before the temporary leave of absence was applied to the policy. Access this functionality through PolicyHub.

NSW Small Business Stamp Duty Exemption Application

If your business requires a NSW Small Business Stamp Duty Exemption you can process this application via PolicyHub.